EMERGENT

Critically, release 13 modules are

high-bandwidth, supporting 5Mbps

uplinks and 10Mbps downlinks.

They’ll also be affordable, costing

$5 to $10 per module, which is in

line with 2G telematics options. They

also boast a 10-year battery life,

which makes them highly applicable

to industrial, automated environ-

ments where sensors are remote or

difficult to reach for battery changes.

They are also designed in such a

way that they will have much better

in-building penetration.

With all of these improvements,

it becomes possible to do things

such as affordably place high-speed

cellular radios in manufacturing

plants and factories. With high-

speed data transfer and low latency

it’s possible to perform real-time

analytics and decision-making,

which will make an even longer-

term impact on the industrial sector.

For instance, it becomes possible

to affordably support applications

such as HD video surveillance for

real-time traffic alerts and remote,

real-time, long-distance medical

procedures in rural communities.

Against this backdrop, channel

partners have an opportunity to sell

the hardware and the connectivity,

but also value-added services includ-

ing management and bundles around

the data itself – such as analytics,

tailored to specific verticals.

AT&T is thinking along these

lines. According to Mobeen Khan,

associate vice president of industrial

IoT solutions at AT&T Mobility Busi-

ness Solutions, AT&T sees its own

value proposition within the industrial

opportunity as being made up of

three parts: connectivity, platforms

and applications.

“We can’t just offer a cellular-

enabled end device. We can support

a set of assets connected via satel-

lite, mesh, Wi-Fi and cellular, and we

need to provide a level of security

and management across those,”

Khan said. “We have a multi-network

strategy – we recognize that we have

to play with others.”

Khan noted that AT&T is looking

for ways to interface with enterprise

platforms such as SAP or

Saleforce. com, including offering a path to in-

tegrate the provider’s control center

connectivity management platform

into the mix.

o

and public clouds–versus just a

How will your hybrid cloud strat

over the next two years?

Source: Forbes Insights; Cisco; survey of 302 IT ex

Source: Business Insider

IoT Connected Endpoints

Source: 451 Research

Source: IHS

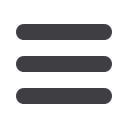

5G Upgrade Drivers: Use Cases, per Mobile Service Providers

Incorporated Into Overall IT

Capex/Opex Budgets

63%

Does your organization gather data or information from any equipment, devices or

other connected endpoints?

Funding for IoT Initiatives

Please describe how your organization plans to fund its IoT Initiative/projects

2034E

2032E

2030E

2028E

2026E

2024E

2022E

2020E

2018E

2016E

2014E

0

Data Points G

loT

HD and UHD video services

Faster broadband internet

Real time gaming

AR/VR

Tactile low latency touch and steer

Factory automation

Medical emergency situations

Autonomous driving

Disaster alerts

Connected car software update

79%

75%

71%

63%

58%

58%

58%

50%

33%

25%

13%

0%

20%

40%

60%

80%

Use Cases

Percent of Respondents Rating 6 or 7

63%

47%

42%

39%

32%

24%

24%

17%

16%

13%

11%

11%

4%

Data center IT Equipment

Cameras/Surveillance Equipment

Smartphones & End User Devices

Data center Facilities Equipment

Building and Other Structures Environmental Sensors Industry Specific/Field Equipment Automobiles/Fleet Equipment Factory EquipmentRetail Operations & Physical Advertising

Devices in Supply Chain

Medical Devices

Other

3%

6

21%

5

3%

9%

13%

35%

30%

11%

25%

35%

What per ntage of your hybrid

is on-premises versus public cl

What is the primary reason your organiza

or w

ill not deploy an SD-WAN?

Source: FlexJobs; Global Workplace Analytics

Telecommuting growth since 2005

2006

150%

100%

50%

26%

4% 5% 9% 4% 3%

36%

55% 61%

66%

0%

2007 2008 2009 2010

Non-telecommuters

Telecommuters

1

%2%

Too insecure

Need a service with

% growth since 2005

Growth in

Corporate Value

Time

Invested:

Less Than

One Day

Profit Margins vs.

Agent Commissions

52%

15%

blulogix.comStop Giving Customers Away,

Be Your Own Service Provider

Channel

Vision

|

July - August, 2017

16